Posted in: Comics | Tagged: Comics, delays, paper, printers, printing

There Is Not Enough Paper In America For Comic Books Right Now

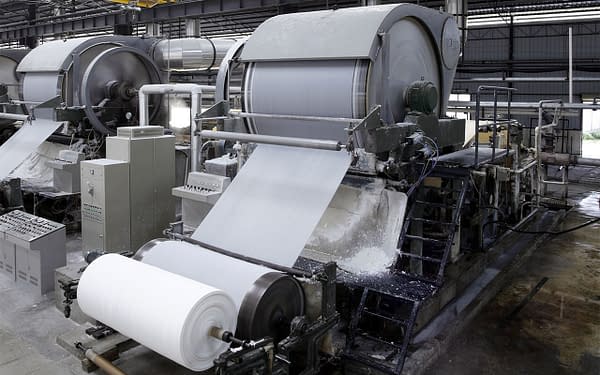

Comic books, more than many printed media, are vulnerable to issues with printing. Paper stock, and image reproduction are more of an issue for a graphic novel than a novel. Bleeding Cool has been reporting major delays and stock issues hitting the comics industry, including information from Bad Idea, DC Comics and from Marvel Comics, while there is still a "manga drought" from East Asia. This week we have been informed by a major printer in the field that "we continue to experience pricing and supply chain challenges in many sectors of our business – primarily in the graphic paper (commercial papers, SBS board, and corrugate), ocean, and road freight and branded merchandise markets. All continue to experience extreme volatility, including price increases, extended lead times, product shortages, reduced capacity, and longer transit times." Here is information that is being shared by printers with their customers, about the issues arising and what publishers need to start doing, including that "there is simply not enough paper making capacity to support the current domestic demand."

Graphic Papers/SBS Board: As previously communicated in early summer months, the graphic paper market (coated and uncoated commercial paper and SBS board) continues to experience extreme volatility, significant price increases and shortages; these challenges are expected to remain through the balance of 2021 and potentially into first quarter 2022. This is impacting pricing and, in some cases, our ability to procure stock to meet production deadlines. All North American mills oversold into Q4/Q1 2022, and there is simply not enough paper making capacity to support the current domestic demand. As producers seek to maximize machine efficiencies, expect reduced brand and basis weight offerings, including the elimination of entire product lines and basis weights. A fluid North American supply chain of these paper grades is reliant on imports from Europe and Asia. Due to the rising costs of containers, lack of vessel space on ships, and extreme backlogs at ports, this supply has slowed dramatically. In many cases, the landed costs of imported paper products now exceed the prices of domestic made products. The commercial paper and SBS board market will remain extremely tight until global freight lanes normalize or until end-user clients remove demand from the market. Many stakeholders are still conditioned to expect a just-in-time supply of paper. With paper making capacity removed and inventories at an all-time low and/or non-existent, businesses consuming paper must flex to planning and committing their paper requirements months in advance.

- Coated web grades of graphic paper: All mills are on strict allocation and taking monthly moratoriums once their order books are full. An increase of ~6% is being implemented on coated freesheet products in September. Lead times are currently into December/January 2022 with no guarantees on mill order acceptance.

- Uncoated freesheet web grades of graphic paper: All mills are on strict allocation and taking monthly moratoriums once their order books are full. An increase of ~6-8% is being implemented on uncoated freesheet products in September. Lead times are currently into November/December.

- Coated and uncoated sheetfed and digital grades of graphic paper: Inventories have been exhausted for these grades; as a result, mill-order lead times have increased significantly and replenishment of merchant inventory levels cannot keep up. An increase of ~6-8% is being implemented in September. Additionally, mills have prioritized the production of web grades and premium sheets over economy grades. What was previously available through merchants from mill inventories in 2-3 days is now taking 12-16 weeks.

- SBS and folding board: Inventories have been exhausted for these grades. Lead times are currently into October/November for mill orders.

- Imports and private labels: Available inventories are purchased almost immediately after they have been restocked. Port processing times are majorly delaying replenishments. Lead times have become unpredictable and entirely dependent on accessing containers, vessels, and throughput at ports.

Corrugate: Much of the disruption in the corrugate industry occurred in late 2020 through mid-2021. New linerboard machines are beginning to come online to help alleviate the demand pressure, however the rise in the Delta COVID variant and the ability to hire hourly workers combined with retail busy season has once again stressed supply. There is an expected price increase (TBD) and potential lead time expansion expected in September/October months.

Plastics: The plastics market is still showing signs of strengthening with respect to availability and lead times. Mill quotes have been holding valid for 30 days, showing enough access to feedstock and resins. However, prices are still as high as where they were early summer and expected to rise again. The first decrease (of 6%) for styrene set in mid-July, was met with an eclipsing increase in August. Polymer prices have not fallen in the summer months and we expect them to rise again in the fall. We have been alerted to disruptions from Hurricane Ida and there is still uncertainty within the market as to how petro demand and refined products will be supported in the fall/winter months with heavy rise of the Delta COVID variant in refinery states (i.e., the ability to hire hourly workers). Lead times on mill orders may begin to increase as we move into the fourth quarter. Inventory levels of finished substrates should continue to grow; however, prices will likely stay elevated and potentially rise through fall months. We will be monitoring the market closely and working with our print partners to ensure any beneficial positions are reflected appropriately when prices do start falling again. For reference, styrene's, coroplast (fluted polypropylene), and vinyl products (rigid & films), are the most affected synthetic substrates.

What Can Be Done? The best path through these unprecedented supply chain challenges for paper, substrates, ocean freight and branded merch is communication of the supply chain challenges, planning requirements well in advance, committing to projects early and remaining flexible.

- Communicate. Collaborate on what projects are expected to be produced and their volumes. There are market challenges and price increases. This market volatility is driven by factors largely outside of our control. There is no guaranteed way to "mitigate" price increases (though we may be able to delay the implementation date), shortages and/or availability of paper. The state of the marketplace isn't limited to certain grades – the price increases, lead times and potential shortages are happening everywhere and across all categories of paper. We are working with the key print partners that support your account on how their paper inventory/supply is being protected and if they see any risk in support your programs. Ordering timelines may need to be adjusted, especially with program type work.

- Plan. In some cases, the quickest availability of paper might be 3-4 months out. The JIT inventory levels supported by paper merchants is very small compared to where mill inventories have been operating. Merchants are on extended replenishment cycles with the mills to always have paper, but their inventory positions are not growing in these conditions, and the merchant inventory is not guaranteed, especially when the paper is allocated, and mills are taking moratoriums. We will communicate any new timeline requirements for ordering paper and take that into account in our planning process. If quantities increase, we will be mindful of paper availability prior to committing to increase.

- Commit early. Our print partners are informing us of increasing paper lead times and potentially unavailable material options. We will need you to commit as early as possible to authorize the ordering of paper. Even if quantities, artwork, and versions are not finalized yet, try to at least commit to a realistic estimate of what you might need.

- Be flexible. We may recommend using different basis weights/grades of paper to complete a project. Flexibility may also mean moving the business to different printer(s) who might have access and/or quicker access to the papers needed to support the project. Now may not be the time to test new formats or production methodologies requiring a different grade/basis weight of paper/substrate.

Plan early for your holiday needs. Stock orders will need to be placed as soon as possible to ensure inventory is available and can be completed on-time.

Any information that readers have to share with Bleeding Cool, we would be most grateful for, and anonymity will be assured.