Posted in: Comics, Current News | Tagged: bankruptcy, diamond

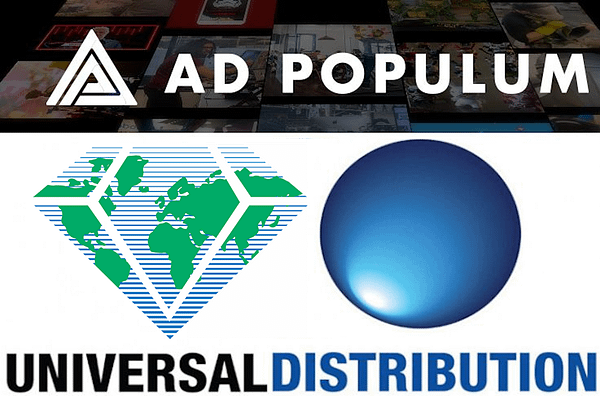

Bankruptcy Courts Approve Sale Of Diamond To Universal/Sparkle Pop

Bankruptcy Courts approve the sale of Diamond Comics to Universal Distribution and Ad Populum/Sparkle Pop but with a $12 million discount

Well, that's another twist and turn. Bleeding Cool told you that a new hearing in the Diamond Comic Distributors Chapter 11/Chapter 7 bankruptcy case was taking place in the Baltimore courts today, even if the main issue they were meant to be hearing had changed significantly since it was filed.

Reports from the court state that, quite simply, the Baltimore Bankruptcy Court have approved the sale of Diamond Comic Distributors to the back-up bidders in the auction, Universal Distribution and Sparkle Pop, a holding company for Ad Populum. Who will get what is currently redacted by the courts.

The sale also excludes certain Diamond-founder/owner Steve Geppi-associated people projects, including Gemstone Publishing, Diamond International Galleries and "any relative of Steven A. Geppi by third level of consanguinity, current and former spouses of Steven A. Geppi"

Universal Distribution will pay $49,634,950, plus or minus a few other factors. Sparkle Pop will pay $7,459,050, though with certain provisos for payments owed to NECA and WizKids, brands owned by Ad Populum. That's a total of around $57 million.

That is significantly lower than their highest bid in the auction of $69,130,000, which saw Universal pay the same, but Ad Populum to pay $19,495,050 for the rest. That's a $12 million discount on the price, and all of it in Ad Populum/Sparkle Pop's favour. AENT states that their rejected bid in the bankruptcy auction came to $72,245,000, though in reality, it ended up topping eighty million. That's quite a disparity to explain.

However, the ongoing "DiP" funding has also been granted, so Diamond Comic Distribution will continue operations while they sort everything out. The shortening of the procedural time has also been approved, so they can just get on with it.

Obviously, we have not heard the last of the spurned AENT, which bid more, then got pushed aside. They are suing for compensation and filed a complaint about the proposed hurried closing of the deal. But (I hope) that is for another day. You can use these Diamond and bankruptcy tags to keep up with the latest on Bleeding Cool.