Posted in: Comics, Current News | Tagged: Alliance Entertainment, bankruptcy, diamond

Alliance Entertainment Stock Price Up 13% After Buying Diamond Comics

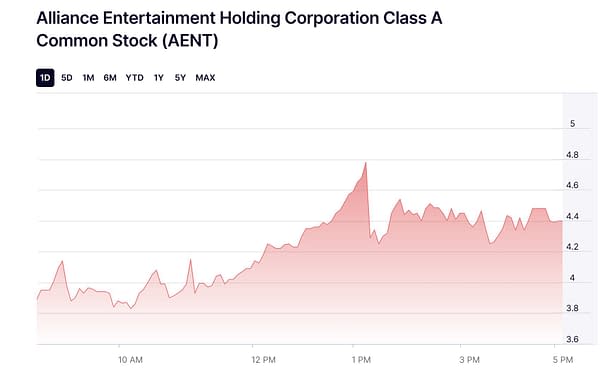

Alliance Entertainment's stock price jumps up 13% at close of market after buying Diamond Comic Distributors

Article Summary

- Alliance Entertainment sees a 13% stock surge after acquiring Diamond Comic Distributors.

- NASDAQ closes Alliance shares at $4.40, following the Diamond Comics acquisition news.

- Acquisition includes Diamond Comics, Alliance Game Distributors, and more, pending court approval.

- Alliance plans to fund buyout via increased credit facility, boosting publisher payouts.

Alliance Entertainment, the new purchasers of Diamond Comic Distributors, after their Chapter 11 Bankruptcy, are a public company and listed on the NASDAQ exchange. Which means they are subject to minute by minute scrutiny with their stock price seen as the ultimate judgment in any and all of their decisions. Even if very little can actually be concluded from it all. Well, today's NASDAQ closed on Alliance Entertainment at $4.40 a share after, at one point, rising to $4.68 a share. Yesterday, before the announcement, it closed at $3.91. So basically, shares put on 50 cents during the day, a rise of almost 13% in reaction to the Diamond Comic Distributors news. That's not bad. What will it be when the news spreads more widely, and the impact sinks in tomorrow? No idea. Will we report it? Possibly. Could it get dull quickly? Definitely.

This morning, Bleeding Cool announced that Alliance Entertainment Holding Corporation had won the bid to acquire substantially all of the assets of Diamond Comic Distributors after Chapter 11 bankruptcy proceedings. That Alliance Entertainment is a global distributor and wholesaler specializing in music, movies, video games, electronics, arcades, and collectables. And while the proposed acquisition, which is subject to Bankruptcy Court approval, includes Diamond Comic Distributors (U.S.), Alliance Game Distributors (no relation), Diamond Select Toys & Collectibles, and Collectible Grading Authority, there was no mention yet of the fate of other assets such as Diamond UK, Diamond Select Toys, FandomWorld, Gentle Giant or Free Comic Book Day.

Bleeding Cool did report that there were multiple competitive bids and that the price Alliance paid was significantly more than anyone anticipated, which should be good news for publishers in terms of getting some of at least what is due to them. And that Alliance Entertainment's intent to finance the acquisition through "an amendment to its existing $120 million Revolving Credit Facility, which it expects to increase to $160 million" is still subject to final bankruptcy court approval and customary closing conditions. We will be examining the paperwork closely.