Posted in: ABC, Freeform, FX, TV | Tagged: ABC, bob iger, disney, freeform, fx

Disney Not Selling ABC, FX, Other Linears; Iger Just Thinking Aloud

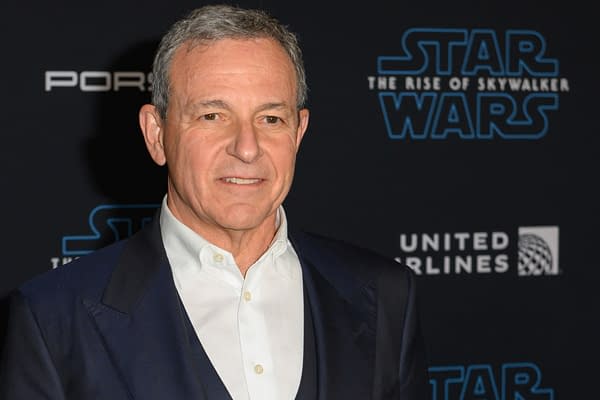

Despite rumblings, Disney CEO Bob Iger confirmed that the company isn't looking to sell ABC, FX, or any its other linear networks.

Back in July, The Walt Disney Company CEO Bob Iger made a whole lot of headlines when he described the proposals from the WGA & SAG-AFTRA to the studios & streamers as not "realistic" during an interview with CNBC. But what got lost in all of that were the comments that Iger made regarding the future of The Mouse's linear television properties – ABC, FX, Disney Channel, Freeform, and others. Revealing that the company needed to be "open-minded and objective about the future of those businesses," Iger added that those properties "may not be core" to Disney's future business plans – especially in the "wild, wild west" days of streaming.

Two months later, Tom Carter, a former Nexstar executive & senior advisor to CEO Perry Sook & the company's board of directors, shared at a conference that Nexstar (the new owners of The CW) could purchase the Disney stations with "little friction" and teased that there might be a chance to do just that "depending on how things fall out." That resulted in rumors that Disney had already entered into talks about unloading the linear networks – rumors that Disney would push back on in a statement. "While we are open to considering a variety of strategic options for our linear businesses, at this time, The Walt Disney Company has made no decision with respect to the divestiture of ABC or any other property, and any report to that effect is unfounded," read the statement released.

And now, Iger is making it clear via a one-on-one with Andrew Ross Sorkin during The New York Times DealBook Summit earlier today that linear is "not for sale." In fact, the CEO explains that his comments were more about testing "Wall Street waters" and public opinion than announcing any definitive decisions on the networks. "Sometimes, when I am looking for a reaction to my own thought process, I like to test that process in public, particularly in ways that I might be able to get a reaction from the investment community," Iger explained. "So, my thought was at the time that I would essentially be public with that thought process."

As Iger saw it, going public with the possibility of selling the networks "was a means of my saying to Wall Street or the investment community that our heads were not in the sand about the challenges those businesses were having." The CEO added, "I did not want to get accused of being kind of an old media executive. Our company had already shown the ability to basically adapt to new circumstances. So, 1) I wanted to convey that and 2) see what the reaction would be. .. I did not say they were for sale. The coverage of what I said said they were for sale."

Though the company is "constantly evaluating" its value in the here and now & the future, Iger made it clear that there isn't a "not for sale" on the linear networks – no matter what the press writes or prospective buyers like Byron Allen and Nexstar want. In fact, Iger addressed an evaluation of how the linear networks were performing – one that apparently showed improvement from the summer (when Iger first made his comments).

"We've determined a few things — 1) that they can be run more efficiently, with some difficult choices. … Second, they can be run in partnership with [streaming]. .. They're a means of aggregating audience and amortizing costs, of basically reaching more and different people. .. Through this process of being more public about what might happen or what could happen and really rolling up sleeves to see, is this something we should do? Should they be divested? Should they be kept? If they are kept, how should they be run? They're being run more efficiently today than in July when I made those comments," Iger explained.