Posted in: Comics, Current News | Tagged: baltimore, bankruptcy, diamond

Here's The Diamond Bankruptcy Letter Sent to Debtors About The Auction

Here's the bankruptcy letter that Diamond Comic Distributors sent to debtors about the auction.

Article Summary

- Diamond Comic Distributors files for Chapter 11 bankruptcy, assets set for auction.

- Key assets: Diamond Comic Distributors, UK division, and Diamond Book Distributors.

- Auction scheduled for March 24, 2025, with important bidding and objection deadlines.

- Sale aims to clear assets of all prior claims, enabling new ownership without liabilities.

Bleeding Cool has a copy of the official documents sent to debtors of Diamond Comic Distributors in the wake of their declaration of Chapter 11 bankruptcy at the beginning of the year. You can follow Bleeding Cool's in-depth coverage of that story here. It lists the assets being auctioned as Diamond Comic Distributors, Diamond Book Distributors, Alliance Game Distributors, Collectible Grading Authority (CGA), FandomWorld, FreeComicBookDay.com, Gentle Giant Ltd, Ironguard Supplies, Diamond Select Toys & Collectibles, Inc., Diamond Comic Holdings, Inc. and Diamond Comic Distributors UK. There is no specific mention of Diamond International Galleries, Geppi's Entertainment Museum, Gemstone Publishing, or the Overstreet Comic Book Price Guide. They may be part of the above, may be entirely separate to the ownership of Diamond, or may be part of the items that are in dispute of the ownership. The auction, as previously reported, will take place later this month and will conclude by the second week of April. The papers are below, a transcription follows:

- Diamond bankruptcy papers

- Diamond bankruptcy papers

- Diamond bankruptcy papers

- Diamond bankruptcy papers

- Diamond bankruptcy papers

- Diamond bankruptcy papers

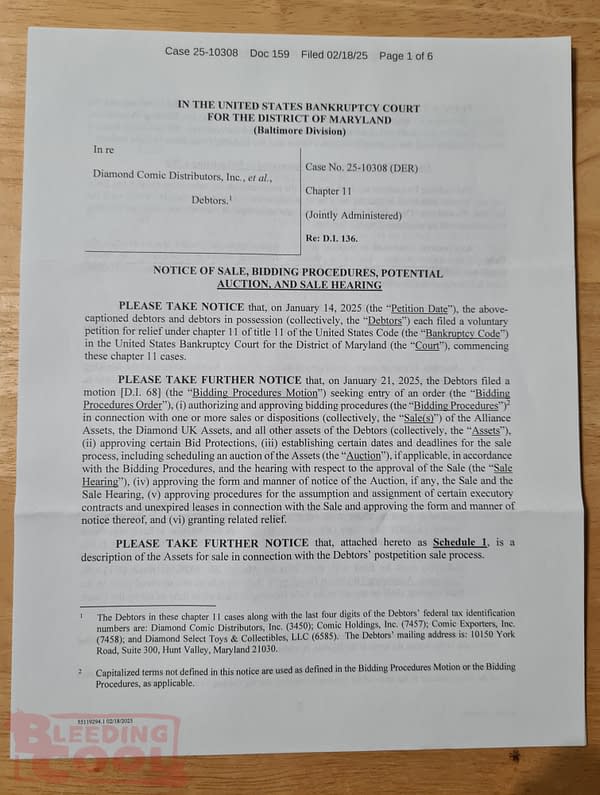

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF MARYLAND (Baltimore Division)

In re:

Diamond Comic Distributors, Inc., et al.,

Debtors¹

Case No. 25-10808 (DER)

Chapter 11

(Jointly Administered)

Re: D.I. 146

NOTICE OF SALE, BIDDING PROCEDURES, AUCTION, AND SALE HEARING

PLEASE TAKE NOTICE that, on January 14, 2025 (the "Petition Date"), the above-captioned debtors and debtors in possession (collectively, the "Debtors") filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the "Bankruptcy Code") in the United States Bankruptcy Court for the District of Maryland (the "Court"), commencing these chapter 11 cases.

PLEASE TAKE FURTHER NOTICE that, on January 21, 2025, the Debtors filed a motion (D.I. 68) (the "Bidding Procedures Motion") seeking entry of an order (the "Bidding Procedures Order") (i) authorizing and approving bidding procedures (the "Bidding Procedures") in connection with one or more sales or dispositions (collectively, the "Sale(s)") of the Alliance Assets, Diamond UK Assets, and all other assets of the Debtors (collectively, the "Assets"), (ii) authorizing certain Bid Protections, (iii) establishing certain dates and deadlines for the sale process, (iv) scheduling the auction (the "Auction") and the sale hearing (the "Sale Hearing") in connection with the Sale(s), (v) approving the form and manner of notice of the Auction, the Sale, and the Sale Hearing, (vi) approving procedures for the assumption and assignment of certain executory contracts and unexpired leases in connection with the Sale and approving the form and manner of notice thereof, and (vii) granting related relief.

PLEASE TAKE FURTHER NOTICE that, attached hereto as Schedule 1, is a description of the Assets for sale in connection with the Debtors' proposed sale process.

¹ The Debtors in these chapter 11 cases, along with the last four digits of the Debtors' federal tax identification numbers, are: Diamond Comic Distributors, Inc. (3158); Diamond UK Holdings, LLC (6585). The Debtors' mailing address is: 10150 York Road, Suite 300, Hunt Valley, Maryland 21030.

Capitalized terms not defined in this notice are used as defined in the Bidding Procedures Motion or the Bidding Procedures, as applicable.

PLEASE TAKE FURTHER NOTICE

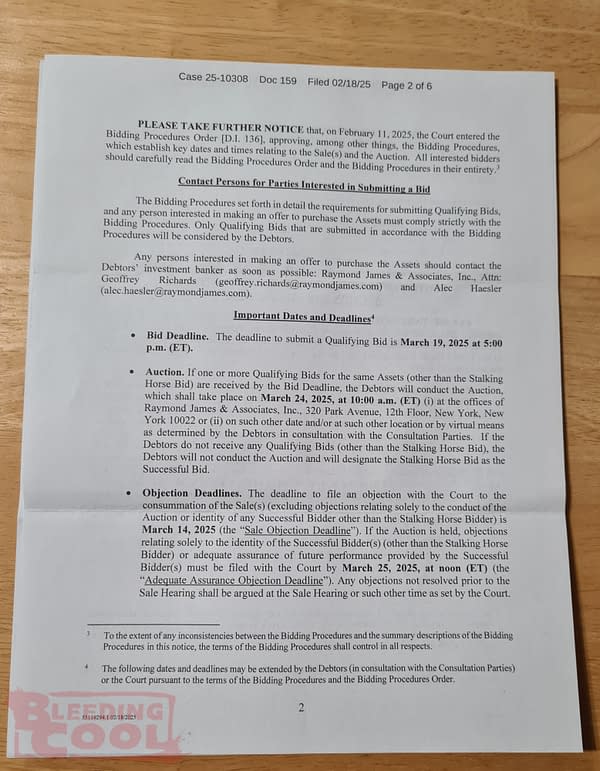

- Bidding Procedures. The Bidding Procedures set forth in the Bidding Procedures Motion were approved by the Court on February 11, 2025, among other things, the Bidding Procedures establish key dates and deadlines for the Sale, which the Debtors should carefully read the Bidding Procedures Order and the Bidding Procedures. All interested bidders should review the Bidding Procedures in their entirety.

- Contact Persons for Parties Interested in Submitting a Bid. The Bidding Procedures set forth in detail the requirements for submitting Qualifying Bids by any person interested in making an offer to purchase the Assets should contact the Debtors' counsel or the Debtors directly: Raymond James & Associates, Inc., Attn: Geoffrey Richards (geoffrey.richards@raymondjames.com) and Alec Haseler (alec.haseler@raymondjames.com).

- Important Dates and Deadlines.

- Bid Deadline. The deadline to submit a Qualifying Bid is March 19, 2025 at 5:00 p.m. (ET).

- Auction. If one or more Qualifying Bids for the Assets (other than the Stalking Horse Bid, as defined below) are received by the Bid Deadline, the Debtors will conduct the Auction, which shall be conducted in person at the offices of Saul Ewing LLP, 1001 Fleet Street, 9th Floor, Baltimore, MD 21202 on March 24, 2025, or such other date and time as the Debtors may notify any Qualifying Bidders other than the Stalking Horse Bidder in accordance with the Bidding Procedures. The Debtors will not conduct the Auction and will designate the Stalking Horse Bid as the Successful Bid.

- Objection Deadlines. The deadline to file an objection with the Court to the consummation of the Sale(s) (excluding objections relating solely to the conduct of the Auction which shall be filed by March 14, 2025) (the "Sale Objection Deadline") relating solely to the identity of the Successful Bidder(s) (other than the Stalking Horse Bidder or adequate assurance of future performance provided by the Successful Bidder(s) ("Adequate Assurance Objection Deadline")) shall be March 26, 2025. Any objections not resolved prior to the Sale Hearing shall be argued at the Sale Hearing, such time as set by the Court.

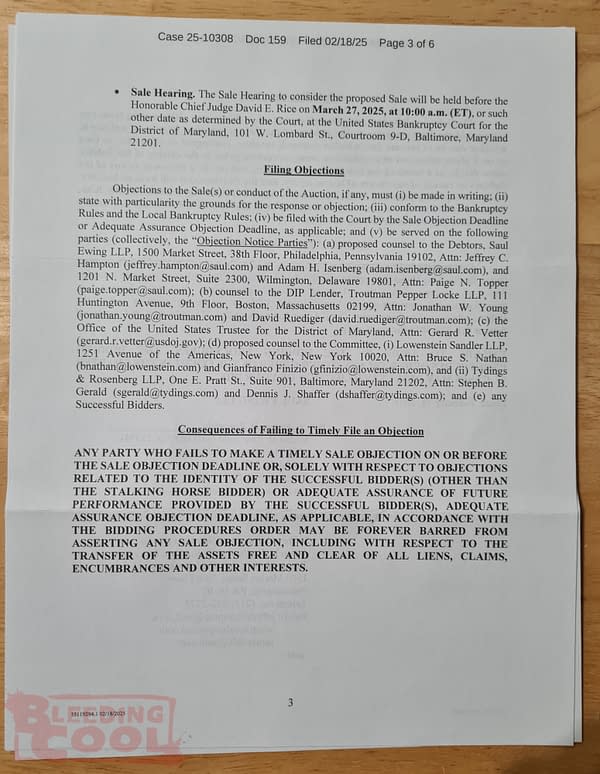

- Sale Hearing. The Sale Hearing to consider the proposed Sale will be held before the Honorable Chief Judge David E. Rice on March 27, 2025, at 10:00 a.m. (ET), or such other date as determined by the Court, at the United States Bankruptcy Court for the District of Maryland, 101 W. Lombard St., Courtroom 9-D, Baltimore, Maryland 21201.

Objections to the Sale(s) or conduct of the Auction. If any, must (i) be in writing, (ii) state with particularity the grounds for the objection, (iii) conform to the Bankruptcy Rules and the Local Bankruptcy Rules, (iv) be filed with the Court by the Sale Objection Deadline or the Adequate Assurance Objection Deadline, as applicable, and (v) be served on the following parties: (a) proposed counsel to the Debtors, Saul Ewing LLP, 1001 Fleet Street, 9th Floor, Baltimore, MD 21202, Attn: Jeffrey C. Hampton (jeffrey.hampton@saul.com) and Adam H. Isenberg (adam.isenberg@saul.com); (b) counsel to the Stalking Horse Bidder, Pepper Hamilton LLP, 1313 Market Street, Suite 5100, Wilmington, DE 19801, Attn: Paige N. Topper (topperp@pepperlaw.com); (c) counsel to the DIP Lender, Troutman Pepper Locke LLP, 1111 Market Street, Suite 2300, Wilmington, DE 19801, Attn: Jonathan W. Young (jonathan.young@troutman.com); (d) proposed counsel to the Committee, (i) Lowenstein Sandler LLP, 1251 Avenue of the Americas, New York, NY 10020, Attn: Bruce S. Nathan (bnathan@lowenstein.com) and Gianfranco Finizio (gfinizio@lowenstein.com), (ii) Tydeco Ventures LLC, 300 E. Pratt St., Suite 901, Baltimore, MD 21201, Attn: Marybeth Stephenson (marybeth.stephenson@tydeco.com), and Denis J. Shaffer (denis.shaffer@tydeco.com); and (e) any Successful Bidder(s).

CONSEQUENCES OF FAILING TO TIMELY FILE AN OBJECTION

ANY PARTY WHO FAILS TO MAKE A TIMELY SALE OBJECTION OR OBJECTION RELATED TO THE IDENTITY OF THE SUCCESSFUL BIDDER(S) (OTHER THAN THE STALKING HORSE BIDDER) OR ADEQUATE ASSURANCE OF FUTURE PERFORMANCE BY THE SUCCESSFUL BIDDER(S) ON OR BEFORE THE SALE OBJECTION DEADLINE OR ADEQUATE ASSURANCE OBJECTION DEADLINE, AS APPLICABLE, IN ACCORDANCE WITH THE BIDDING PROCEDURES ORDER, MAY BE FOREVER BARRED FROM ASSERTING ANY SALE OBJECTION, INCLUDING WITH RESPECT TO THE TRANSFER OF THE ASSETS FREE AND CLEAR OF ALL LIENS, CLAIMS, ENCUMBRANCES AND OTHER INTERESTS.

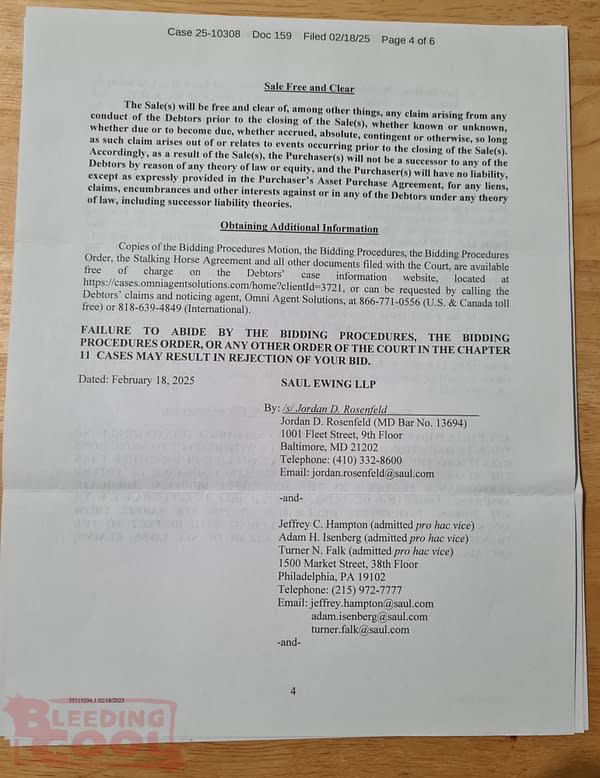

Sale Free and Clear

The Sale(s) will be free and clear of, among other things, any claims arising from any conduct of the Debtors prior to the closing of the Sale(s), whether known or unknown, due or to become due, absolute or contingent, inchoate or otherwise, long as such claims arise out of or relate to events occurring prior to the closing of the Sale(s). Accordingly, as a result of the Sale(s), the Purchaser(s) will not be a successor to the Debtors under any theory of law or equity, and the Purchaser(s) will have no liability, except as expressly provided in any Sale Order or Asset Purchase Agreement, for any liens, claims, encumbrances and other interests against or in any of the Debtors under any theory of law, including successor liability theories.

Obtaining Additional Information

Copies of the Bidding Procedures Motion, the Bidding Procedures, the Stalking Horse Agreement and all other documents filed with the Court, are available free of charge on the Debtors' case information website, located at https://dm.epiq11.com/case/diamond-3721, or can be requested by calling the Debtors' claims and noticing agent Omni Agent Solutions, at 866-751-0554 (U.S. & Canada) toll free or 818-639-5749 (International).

FAILURE TO ABIDE BY ANY OF THE BIDDING PROCEDURES, THE BIDDING PROCEDURES ORDER OR ANY OTHER ORDER OF THE COURT IN THE CHAPTER 11 CASES MAY RESULT IN THE REJECTION OF YOUR BID.

Dated: February 18, 2025

SAUL EWING LLP

By: /s/ Jordan D. Rosenfeld

Jeffrey C. Hampton (admitted pro hac vice)

Turner N. Falk (admitted pro hac vice)

1001 Fleet Street, 9th Floor

Baltimore, MD 21202

Telephone: (410) 332-8600

Email: jordan.rosenfeld@saul.com

-and-

Jeffrey C. Hampton (admitted pro hac vice)

Adam H. Isenberg (admitted pro hac vice)

Turner N. Falk (admitted pro hac vice)

1500 Market Street, 38th Floor

Philadelphia, PA 19102

Telephone: (215) 972-7770

Email: jeffrey.hampton@saul.com

adam.isenberg@saul.com

turner.falk@saul.com

-and-

Mark Minuti (admitted pro hac vice)

Paige N. Topper (admitted pro hac vice)

1201 N Market Street, Suite 2300

Wilmington, DE 19801

Telephone: (302) 421-6800

Email: mark.minuti@saul.com

paige.topper@saul.com

Proposed Counsel for Debtors and Debtors in Possession

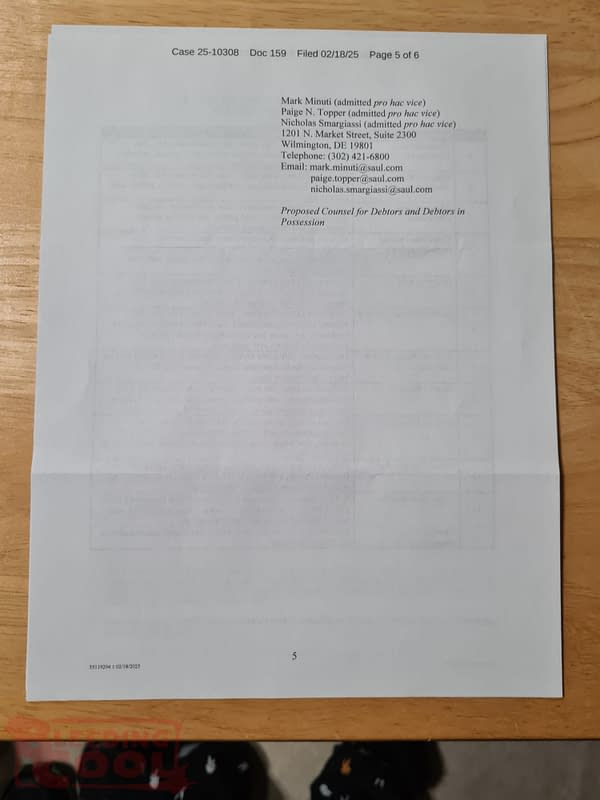

Schedule 1

| Business | Description |

|---|---|

| 1. Diamond Comic Distributors | Division of Debtor Diamond Comic Distributors, Inc., that operates as a distributor of comic books, graphic novels, toys, games, and other pop culture-related merchandise in North America. |

| 2. Diamond Book Distributors | Division of Debtor Diamond Comic Distributors, Inc., that distributes English-language graphic novels, manga, games, and other pop culture merchandise to bookstores, libraries, and other retailers internationally. |

| 3. Alliance Game Distributors | Division of Debtor Diamond Comic Distributors, Inc., that distributes board games, card games, role-playing games, miniatures, and other gaming products. |

| 4. Collectible Grading Authority (CGA) | Division of Debtor Diamond Comic Distributors, Inc., that provides grading, authentication, and encapsulation services for vintage and modern toys, video games, and other related collectibles. |

| 5. FandomWorld | Division of Debtor Diamond Comic Distributors, Inc., that operates an annual promotional event where participating comic shops and retailers offer fans a platform for sale of pop culture merchandise ranging from comic books to toys to collectibles. |

| 6. FreeComicBookDay.com | Division of Debtor Diamond Comic Distributors, Inc., that manages an annual promotional event focused on comic book culture, designed to promote comic book awareness and attract new customers. |

| 7. Gentle Giant Ltd. | Division of Debtor Diamond Select Toys & Collectibles, LLC, that manufactures collectible toys and statues based on licensed intellectual property from among others Disney and Marvel. |

| 8. Ironguard Supplies | Division of Debtor Diamond Comic Distributors, Inc., that manufactures card supplies, comic supplies, and display products, including card binders, card sleeves, magna-armor, backer boards, and comic bags. |

| 9. Diamond Select Toys & Collectibles, Inc. | Holding company that owns 50% of Debtor Diamond Comic Distributors UK, a distributor of comic books, collectibles, merchandise, and related items in the United Kingdom. |

| 10. Diamond Comic Holdings, Inc. | Holding company that owns 100% of non-Debtor Diamond Comic Distributors UK, a distributor of comic books, collectibles, merchandise, and related items in the United Kingdom. |

| 11. Diamond Comic Distributors UK | Division of Debtor Diamond Comic Distributors, Inc., that distributes comic books, collectibles, merchandise, and related items in the United Kingdom. |