Posted in: Comics, Current News | Tagged: comic shop, diamond

Will Diamond's Bankruptcy Process Go After Comic Shops' Debts?

How much will the court's bankruptcy process for Diamond Comic Distributors demand of their comic book shops over possible debts?

Article Summary

- Diamond seeks $41 million in financing to keep operations running during Chapter 11 proceedings.

- Universal Distribution eyes Diamond assets with a stalking horse bid to set auction floor price.

- Top creditors owed over $30 million; full debts estimated at $70-80 million, impacting publishers.

- Retailer debts vital as Diamond attempts cashflow positivity; ongoing restructuring determines future.

According to documents filed over the past few days, as part of bankruptcy proceedings, Diamond Comic Distributors has sought approval from the United States Bankruptcy Court for interim and final orders allowing them to obtain financing and use their available cash during the bankruptcy proceedings. They are requesting permission to secure financing and use their existing cash reserves to continue business operations during Chapter 11 proceedings, including payroll, vendor payments, shipping, and other operational costs.

Diamond has sought approval for a $41 million credit facility, subject to conditions laid out during the bankruptcy process. The proposed Debtor-in-Possession (DIP) lender would be JPMorgan Chase Bank, which would give the bank priority on Diamond's assets if the Chapter 11 process is unsuccessful, though they state that adequate protection will be provided to existing secured lenders. They also want to use their financial reserves as a "carve out" to ensure payment of professional fees and administrative costs even if the financing is exhausted. So the lawyers get paid, as ever.

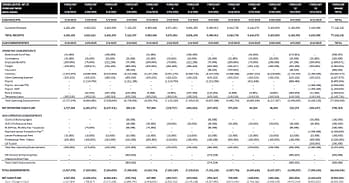

In bankruptcy court documents, Diamond states that this financing is crucial for their ability to operate, as they lack the liquidity to continue operations without immediate access to funds. They also essentially intend to sell a large number and perhaps all of their assets as part of the bankruptcy restructuring process, with a target of raising around $41-$43 million from selling these assets. They have also laid out the traditional 13-week budget, which is a standard Chapter 11 procedure. They have also set milestones for various steps needed towards being able to auction the assets. On January 16, the court approved Diamond's motion to extend the deadline for providing their schedules of assets and liabilities and statements of financial affairs to February 17, 2025.

Why is Universal a stalking horse?

Universal Distribution of Canada has been named a potential stalking horse bidder, which means they have already made an initial offer for the assets. Alliance Games Distributors and Diamond UK have both been specifically named as assets that Universal has agreed to acquire. Their bid, however, sets the floor price for the auction and may include incentives, such as break-up fees or expense reimbursements, to compensate the stalking horse bidder for participating in the process. Of course, the auction of assets is intended to generate the highest possible value for creditors and stakeholders. It is also meant to ensure an organized transition of Diamond's auctioned assets to new ownership, reducing the risk of operational disruption and preserving business continuity.

According to court documents, there is also a success fee for JPMorgan Chase Bank based on the sale achieved, though if proceeds are less than $42 million, no success fee is payable. If sale proceeds are between $42 million and $43 million, a 1.5% success fee is triggered. If sale proceeds exceed $43 million, a 2.5% success fee is triggered. This structure creates an implicit goal to achieve proceeds of at least $43 million to fully satisfy the DIP obligations and provide for additional recoveries. However, it is notable that debts to just the top thirty creditors (and there are hundreds and hundreds) are over thirty million. The total amount owed to all creditors may be in excess of sixty million.

Where will all of that money come from? The auction of various assets including equipment, property, the split-off companies such as Alliance Games and Diamond UK, both of which are still viable businesses. But also… the money that comic book stores still owe to Diamond. The likes of San Francisco retailer Brian Hibbs have been keen to point out how Diamond has worked as a bank for comic book retailers in the direct market over the decades. Well, it will be time to call those debts up as well.

How much will the retailers have to pony up?

Is the court going to want late retailer accounts to pay up? And just how much of a haircut of the money Diamond owes them are the publishers going to take? Also, if Diamond continues to run through Chapter 11, and Universal buys Alliance, will Diamond and Alliance/Universal be sharing a warehouse? And how will Diamond UK cope with their new Canadian overlords? Diamond UK has enjoyed a lot of autonomy since they were Titan Distributors and bought by Diamond, rather than being subsumed as the other American distributors. This also might be why Diamond UK is still in fine fettle despite crashing pounds and Brexit challenges.

It's also worth noting that the net cash flow for the budget drawn out in the traditional 13-week operational window is not in the red for every period. So they have seemingly been able to convince JPMorgan Chase Bank and/or the court that they have the means to get the cash flow consistently positive if they can get some help with the overall debt.

Now, whether these projections include retailers and publishers moving more of their orders to other distributors, as appears to be happening, that's a story for another day. We should know more about that when Diamond submits their schedules of assets and liabilities and statements of financial affairs.